Companies relocating to Franklin County, NC and existing companies may qualify for a variety incentives and financial assistance through several agencies and programs.

State:

2.5%

Corporate Income Tax Rate, Lowest in the U.S. By 2030, 0% State Corporate Income

5%

Top State Corporate Capital Gains Tax

5.25%

Top State Personal Income Tax

5.8%

Top State Personal Capital Gains Tax

4.75%

State Sales Tax

2025 Franklin County, NC Ad Valorem Tax Rate

Per $100 Assessed Value

- Franklin County $0.505

- Bunn $0.45

- Franklinton $0.71

- Louisburg $0.50

- Youngsville $0.54

- Wake Forest $0.42

Franklin County Sales Tax

-

Franklin

County 2% -

NC State

Sales Tax 4.75% - Total: 6.75%

Incentives – Local, State, and Federal

The Franklin County, NC Economic Development Department will work with companies to identify potential sources of financial assistance for qualifying projects.

One North Carolina Fund

May provide financial assistance to businesses and industries deemed by the governor to be vital to a healthy and growing state economy and making significant efforts to expand in North Carolina. The One NC Fund is a competitive fund and the location or expansion must be in competition with another location outside of North Carolina. Criteria for the program is available through the N.C. Department of Commerce Finance Center.

Job Development Investment Grant

May provide sustained annual grants to new and expanding businesses measured against a percentage of withholding taxes paid by new employees. The program is discretionary and competitive and the Economic Investment Committee, which oversees it, can award up to 25 grants in a calendar year. Criteria for the program is available through the N.C. Department of Commerce Finance Center.

For additional information on NC state incentives, visit the

Economic Development Partnership of North Carolina.

Dislocated Worker Program

Reimburses a percentage of retraining costs.

Federal Programs

New Market Tax Credit

Encourages private capital investment in designated communities by offering individual and corporate investors a federal income tax credit for equity investments in Community Development Entities (CDEs). The tax credit equals 39% of the original investment and is claimed over seven years. https://www.cdfifund.gov/cims

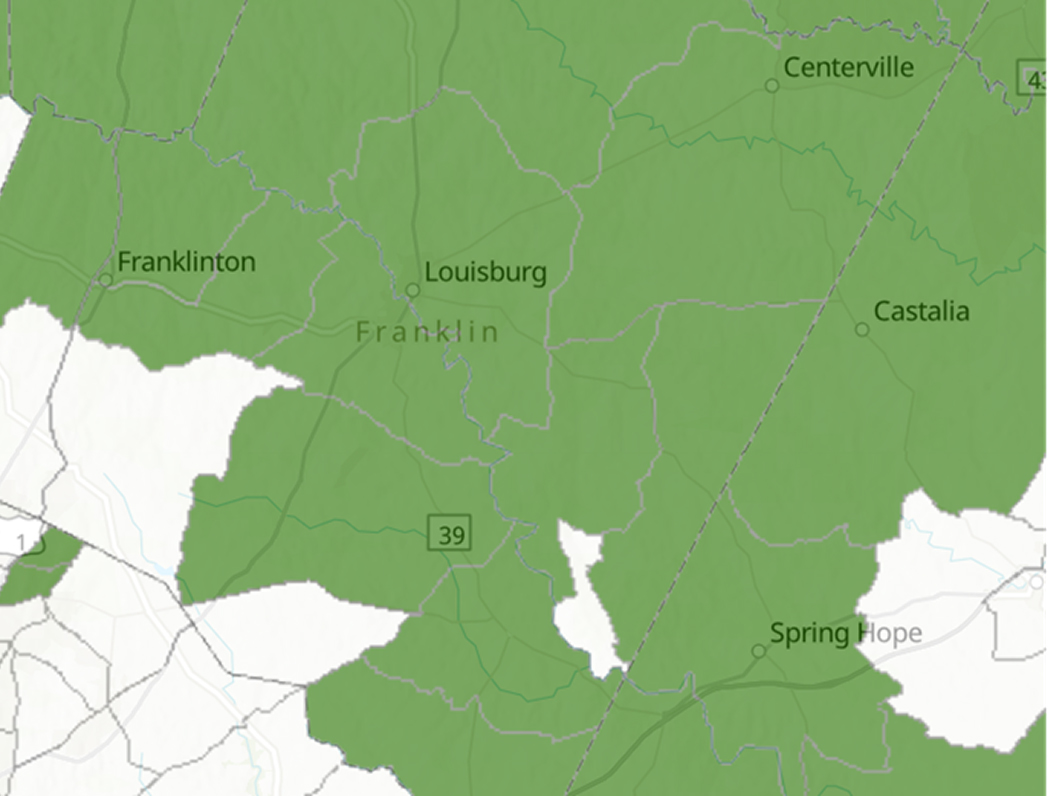

Franklin County, NC New Market Tax Credits Eligible Census Tracts

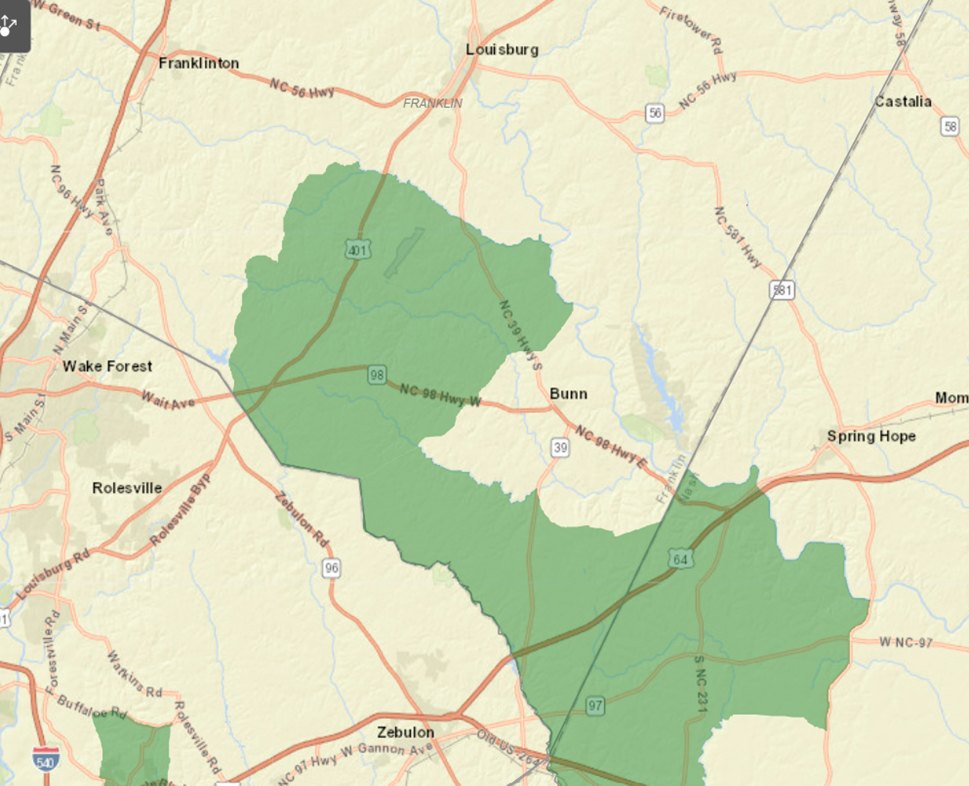

Franklin County, NC Opportunity Zone Qualified Census Tracts Map

North Carolina Opportunity Zones provide qualified investors with tax benefits when they reinvest unrealized capital gains into these designated areas:

North Carolina Opportunity Zones Map

Franklin County has several qualified census tracts, including one located at the Triangle North Franklin Business Park.